How Can I Protect My Identity After a Social Security Number Breach?

Protecting Yourself After Your Social Security Number Has Been Compromised

Discovering that your Social Security number (SSN) has been compromised can be a stressful experience, especially for older adults and families with young children who are particularly vulnerable to identity theft1. It's crucial to act quickly to minimize potential damage and protect your identity and finances. How Can I Protect My Identity After a Social Security Number Breach? This article outlines the steps you should take if you believe your SSN has been compromised.

Check Out the Full Podcast Episode:

Potential Signs of a Compromised SSN

Before diving into the necessary actions, it's important to recognize the signs that your SSN may have been compromised. These include: 2

- Receiving a notice from a company about a data

- Receiving a notification from your credit card company about suspicious

- Receiving a notice from the IRS about discrepancies in your

Immediate Actions

1. Report the Identity Theft to the Federal Trade Commission (FTC)

The FTC is the primary federal agency that handles identity theft cases. Reporting the theft to the FTC is a critical first step. You can file a report online at IdentityTheft.gov or by calling 1-877-ID-THEFT (1-877-438-4338). The FTC will create a personalized recovery plan and provide valuable resources to guide you through the recovery process3.

2. Notify the Police

Filing a police report creates an official record of the identity theft, which can be helpful when dealing with creditors and financial institutions. Bring a copy of your FTC Identity Theft Report, a government-issued photo ID, proof of address, and any evidence of the theft when you file the report3.

3. Place a Fraud Alert or Credit Freeze on Your Credit Reports

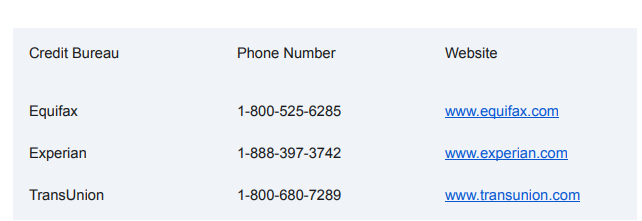

A fraud alert warns creditors that you may be a victim of identity theft and requires them to take extra steps to verify your identity before issuing credit. An initial fraud alert stays in your file for at least one year, while an extended fraud alert lasts for seven years4. You can contact any of the three credit bureaus online, by phone, or by mail to place a fraud alert. The credit bureau you contact must notify the other two4.

A credit freeze is the most effective way to restrict access to your credit reports, making it much harder for identity thieves to open new accounts in your name6. You can lift the freeze temporarily or permanently when you need to apply for credit yourself.

To place a fraud alert or credit freeze, contact one of the three major credit bureaus:

Types of Fraud Alerts: 7

- Temporary Fraud Alert: This alert does not require a reason or documentation beyond confirming your identity and automatically expires in one year.

- Extended Fraud Alert: This alert generally requires a police report and stays active for seven years.

Removing a Fraud Alert: 7

To remove a fraud alert, you must contact all three credit bureaus, and they will need to verify your identity to lift the alert.

4. Notify the IRS

If someone has your SSN, they might try to file a fraudulent tax return and steal your refund. To prevent this, notify the IRS by calling 1-800-908-4490 or by filling out Form 14039, Identity Theft Affidavit2.

5. Request an IP PIN from the IRS

An Identity Protection PIN (IP PIN) adds an extra layer of security to your tax filings. It's a six-digit number that the IRS uses to verify your identity when you file your tax return. You can obtain an IP PIN through the IRS website7.

6. Contact Companies Where Your SSN Was Used Fraudulently

If you discover any fraudulent accounts or activity, contact the companies involved immediately. Provide them with a copy of your FTC Identity Theft Report and police report8.

Ongoing Monitoring and Protection

1. Monitor Your Credit Reports Regularly

Review your credit reports from all three credit bureaus for any suspicious activity. You can obtain free copies of your credit reports annually at AnnualCreditReport.com. Consider using a credit monitoring service for more frequent updates and alerts9.

Microsoft Defender's Identity Theft Monitoring: 7

Microsoft Defender offers an identity theft monitoring feature that provides monthly credit report updates and helps you identify unknown credit activity.

2. Monitor Your Bank Accounts and Financial Statements

Regularly review your bank account statements, credit card statements, and other financial documents for any unauthorized transactions. Report any suspicious activity to your financial institutions immediately 8.

3. Create a my Social Security Account

My Social Security account allows you to monitor your Social Security earnings record and benefits, helping you detect any suspicious activity related to your Social Security benefits10.

4. Consider Identity Theft Protection Services

Identity theft protection services offer a variety of features, including credit monitoring, dark web monitoring, and identity theft insurance. These services can provide an extra layer of protection and assistance in recovering from identity theft11. However, it's important to remember that these services cannot prevent your SSN from being stolen in the first place12.

5. Protect Your SSN

Be cautious about sharing your SSN. Only provide it when necessary and avoid sending it electronically or through unsecured websites13.

- Memorize your SSN and keep your Social Security card in a safe

- Never share your SSN over the phone or online unless you initiate the contact and know the other party is legitimate.

- Shred any documents that include your SSN before discarding

Additional Tips

- Change your passwords for all online accounts, especially financial accounts and email accounts2.

- Enable multi-factor authentication (MFA) whenever possible for added security2.

- Be wary of phishing Avoid clicking on links or opening attachments in suspicious emails.

- Shred documents containing your SSN before discarding

- Keep your software and operating systems updated with the latest security

Conclusion

Having your SSN compromised is a serious matter with potentially significant consequences. However, by taking immediate action and implementing the protective measures outlined in this article, you can significantly reduce the risk of identity theft and mitigate its impact. Remember that a credit freeze is one of the most effective ways to prevent new accounts from being opened in your name, and monitoring your accounts and reports regularly is crucial for early detection of suspicious activity. While identity theft protection services offer valuable assistance, they cannot prevent your SSN from being stolen, so proactive measures and vigilance are essential. Take the necessary steps today to protect your identity and financial well-being.

Works cited

- Do You Need Identity Theft Protection? How To Decide, accessed December 14, 2024, https://www.identityguard.com/news/do-i-need-identity-theft-protection

- Was Your SSN Found on the Dark Web? Here's What To , accessed December 14, 2024, https://www.keepersecurity.com/blog/2024/09/11/was-your-ssn-found-on-the-dark-web-heres-wh at-to-do/

- What to Do if Your Social Security Number Is Stolen - Experian, accessed December 14, 2024, https://www.experian.com/blogs/ask-experian/3-steps-to-take-if-your-social-security-number-has-been-stolen/

- Fraud Alert Center at Experian, accessed December 14, 2024, https://www.experian.com/fraud/center.html

- Place a fraud alert on your credit file - gov, accessed December 14, 2024, https://www.mass.gov/info-details/place-a-fraud-alert-on-your-credit-file

- Placing a Security Freeze on Your Credit Report - Illinois Attorney General, accessed December 14, 2024, https://www.illinoisattorneygeneral.gov/Page-Attachments/security_freeze.pdf

- What to do if your Social Security Number (SSN) is exposed ..., accessed December 14, 2024, https://support.microsoft.com/en-us/topic/what-to-do-if-your-social-security-number-ssn-is-expos ed-b08d677f-471d-41be-ac9b-f9f7109f7643

- Steps If Your Social Security Number Is Compromised | General Electric Credit Union, accessed December 14, 2024, https://www.gecreditunion.org/learn/education/resources/money-minutes/october-2024/what-to- do-if-your-social-security-number-is-compromised

- Check Your Free Credit Report for Signs of Fraud and Identity Theft - Financial Education, accessed December 14, 2024, https://finances.extension.wisc.edu/articles/check-your-free-credit-report-for-signs-of-fraud-and-i dentity-theft/

- Fraud Prevention and Reporting | SSA, accessed December 14, 2024, https://www.ssa.gov/fraud/

- Best Identity Theft Protection Services of 2024 - NerdWallet, accessed December 14, 2024, https://www.nerdwallet.com/article/finance/comparing-identity-theft-protection-services

- Is Identity Theft Protection Worth It in 2024? Only in These Cases, accessed December 14, 2024, https://www.aura.com/learn/is-identity-theft-protection-worth-it

- ssa.gov, accessed December 14, 2024, https://www.ssa.gov/pubs/EN-05-10220.pdf

- Protect Yourself from Social Security Number Identity Theft | Equifax, accessed December 14, 2024, https://www.equifax.com/personal/education/identity-theft/articles/-/learn/social-security-number- identity-theft/